By now most of us are making changes to our daily routines to comply with voluntary social distancing. As individuals adjust their routines and figure out how to keep their families safe, companies have to react quickly and decisively to COVID-19 related concerns as well, from dealing with supply chain issues, to customer concerns, to employee matters.

What started out as a remote health concern has quickly become a reality for all individuals and business owners no matter how big or small. Offices, schools, restaurants, bars and many stores remain closed across the United States. The potential life-saving benefits of these disruptions of daily life for many Americans is real and significant and will hopefully flatten the curve and help contain the Novel Coronavirus, but the negative impact of these disruptions is bad for business.

Factory closings, breaks in supply chains and worker quarantines have disrupted supplies. Restrictions on travel and hospitality, and fears regarding contamination have hit demand. With production and spending across much of the country having been brought to an abrupt halt, even if we get the virus itself under control, its financial impact will likely be long-lasting.

Businesses that were on solid ground just a few weeks ago, may need to consider bankruptcy protection to address liquidity issues, supply chain or vendor disruptions, restructure their obligations, or create breathing-room to examine their corporate structure. Until recently a reorganization under Chapter 11 of the United States Bankruptcy Code may have been too burdensome for small businesses to consider as a viable option. But a new bankruptcy law, which only took effect on February 19, 2020, and the Coronavirus Aid, Relief, and Economic Stimulus Act (CARES Act) may help small businesses and individuals engaged in business overcome the economic disruption caused by this pandemic and perhaps properly position them for the post-COVID-19 world, by making Chapter 11 reorganizations a viable option for small business debtors.

The Small Business Reorganization Act of 2019

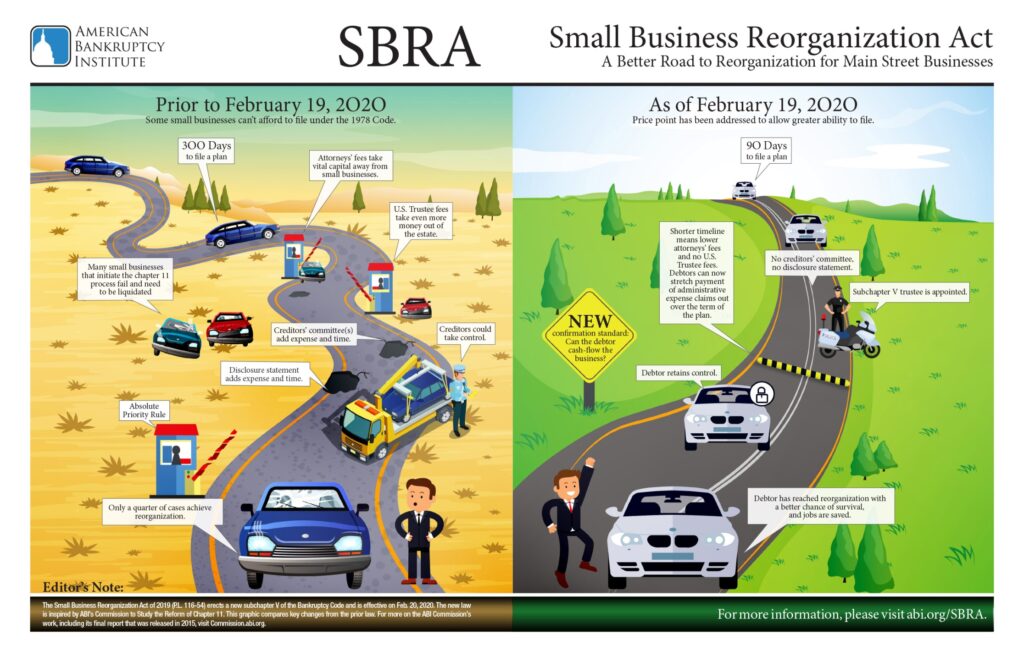

In February 2020, the Small Business Reorganization Act of 2019 (SBRA) went into effect. SBRA created a new subchapter under Chapter 11 of the United States Bankruptcy Code that is commonly referred to as “Subchapter V”.

Reorganizing under chapter 11 of the bankruptcy code has been too onerous and expensive, making it too difficult for small businesses to successfully reorganize. SBRA aims to give businesses with debts that are under a certain threshold a faster and less expensive option for reorganizing under Chapter 11.

Subchapter V includes a number of provisions that make Chapter 11 reorganization cheaper, quicker and more effective for businesses with total debts under $2,725,625. Some of the benefits provided to small businesses under the SBRA, include simpler plan procedures and substantive provisions that make it easier for small business owners to confirm a plan of reorganization and retain equity in their companies.

Under the provisions of Subchapter V, a plan of reorganization allows a debtor to spread the repayment of its debt over 3 to 5 years, using its projected disposable income to make plan payments. In many situations, such a payment plan will benefit both debtors and creditors. Debtors will benefit by being able to spread payments over time. Creditors will be allowed a meaningful recovery from debtors who may not have money on hand, due to the economic disruption caused by the Novel Coronavirus, but have a realistic expectation of income over time.

The Coronavirus Aid, Relief, and Economic Stimulus Act (CARES Act)

The recently enacted CARES Act, designed to aid businesses suffering the effects of the Novel Coronavirus, temporarily raises the debt limit for small businesses looking to file under SBRA from $2,725,625 to $7,500,000, which will enable a far greater number of companies to take advantage of the SBRA.

This change in the debt limit applies only to cases filed after the CARES Act becomes effective and is applicable for one year after the CARES Act becomes effective. After March 27, 2021, the debt limit for cases under Subchapter V will return to $2,725,625 absent an extension by Congress.

Importantly, the CARES Act will allow many more businesses that may benefit from a Chapter 11 reorganization to take advantage of the new provisions of the United States Bankruptcy Code. The increase in the cap on the debt limit was done in the hope that the higher cap will benefit not only small business owners, but also suppliers, creditors, employees, customers, and the overall economy.

The Bottom Line

Taking advantage of the opportunity presented by Subchapter V will allow small businesses to recover from the current economic downfall by suspending obligations long enough to allow negotiations with landlords, lenders, and other creditors and to recommence operations once the immediate threat from COVID-19 recedes.

We find ourselves in the midst of a pandemic which is causing global chaos on a level unprecedented in our lifetimes. From physical suffering to economic turmoil, COVID-19 is clearly affecting the world in calamitous ways. In such times, when one’s current physical safety is at stake, it is difficult to think about the future or future financial health. However, we must find the capacity to not only survive these chaotic and challenging days but to improve our future financial health in order to rise from the negative consequences of the social and economic disruption caused today.

As we continue to monitor COVID-19, we are working collaboratively to stay current on developments and counsel our clients through the various legal and business issues that may arise across a variety of sectors.

Our hearts and thoughts go out to the people who have been affected by this unprecedented event and we appreciate the healthcare workers, local communities, and governments around the world who are on the front line working to contain this Novel Coronavirus.